April is Financial Literacy Month

- 04/01/23

April marks the start of Financial Literacy Month, a nationally recognized movement to promote and support financial understanding in children and teens. For many, it's a fantastic opportunity to teach and connect with their children or grandchildren...

[+] Full Article 2023 Changes to Iowa's Retirement Taxes - 03/01/23

In March of 2022 Iowa Governor Kim Reynolds signed a historic Iowa tax reform bill. One of the biggest changes from the bill is that starting in 2023, Iowans aged 55 or older are exempt from paying state taxes on retirement income...

[+] Full Article

April marks the start of Financial Literacy Month, a nationally recognized movement to promote and support financial understanding in children and teens. For many, it's a fantastic opportunity to teach and connect with their children or grandchildren...

[+] Full Article 2023 Changes to Iowa's Retirement Taxes - 03/01/23

In March of 2022 Iowa Governor Kim Reynolds signed a historic Iowa tax reform bill. One of the biggest changes from the bill is that starting in 2023, Iowans aged 55 or older are exempt from paying state taxes on retirement income...

[+] Full Article

|

|

March 1, 2023 In March of 2022 Iowa Governor Kim Reynolds signed a historic Iowa tax reform bill. One of the biggest changes from the bill is that starting in 2023, Iowans aged 55 or older are exempt from paying state taxes on retirement income... Read more »

Iowa Tax Planning Tax Reduction Tax Reform Tax Withholding Taxation Taxes |

|

|

November 1, 2021 Here are some things you might consider before saying goodbye to 2021. Read more »

Charitable Giving Financial Planning Itemized Deductions Job Change Life Changes Marital Status Money Moves Philanthropy Retirement Tax Withholding Taxes To Do List |

|

|

May 7, 2018 How much attention do you pay to this factor?

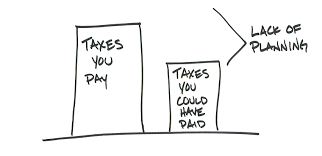

Will you pay higher taxes in retirement? Do you have a lot of money in a 401(k) or a traditional IRA? If so, you may receive significant retirement income. Those income distributions, however, will be taxed at the usual rate. If you have saved and invested well, you may end up retiring at your current marginal tax rate or even a higher one. Read more » |

1