April is Financial Literacy Month

- 04/01/23

April marks the start of Financial Literacy Month, a nationally recognized movement to promote and support financial understanding in children and teens. For many, it's a fantastic opportunity to teach and connect with their children or grandchildren...

[+] Full Article 2023 Changes to Iowa's Retirement Taxes - 03/01/23

In March of 2022 Iowa Governor Kim Reynolds signed a historic Iowa tax reform bill. One of the biggest changes from the bill is that starting in 2023, Iowans aged 55 or older are exempt from paying state taxes on retirement income...

[+] Full Article

April marks the start of Financial Literacy Month, a nationally recognized movement to promote and support financial understanding in children and teens. For many, it's a fantastic opportunity to teach and connect with their children or grandchildren...

[+] Full Article 2023 Changes to Iowa's Retirement Taxes - 03/01/23

In March of 2022 Iowa Governor Kim Reynolds signed a historic Iowa tax reform bill. One of the biggest changes from the bill is that starting in 2023, Iowans aged 55 or older are exempt from paying state taxes on retirement income...

[+] Full Article

|

|

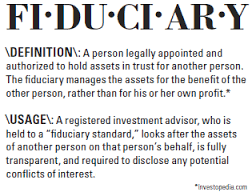

May 3, 2017 What designations let you know that a financial professional will abide by this rule?

This year, the Department of Labor intends to introduce a new rule regarding retirement plan accounts, with full implementation envisioned by 2018. Under this new rule, financial professionals who consult retirement savers will be held to a fiduciary standard of care. In other words, they will have an ethical and legal obligation to always act in a client’s best interest. Read more »

|

|

|

April 19, 2017 Diversification still matters. One day, this bull market will end.

In the first quarter of 2017, the bull market seemed unstoppable. The Dow Jones Industrial Average soared past 20,000 and closed at all-time highs on 12 consecutive trading days. The Nasdaq Composite gained almost 10% in three months. Read more »

|

|

|

March 1, 2017 Instead of just spending the money, you could plan to pay yourself.

About 70% of taxpayers receive sizable refunds from the Internal Revenue Service. Just how sizable? The average refund totals about $2,800. Read more »

|

|

|

|

February 15, 2017 If an investor chooses a non-human financial advisor, what price could they end up paying?

Investors have a choice today that they did not have a decade ago. They can seek investing and retirement planning guidance from a human financial advisor or put their invested assets in the hands of a robo-advisor – a software program that maintains their portfolio. Read more »

|