April is Financial Literacy Month

- 04/01/23

April marks the start of Financial Literacy Month, a nationally recognized movement to promote and support financial understanding in children and teens. For many, it's a fantastic opportunity to teach and connect with their children or grandchildren...

[+] Full Article 2023 Changes to Iowa's Retirement Taxes - 03/01/23

In March of 2022 Iowa Governor Kim Reynolds signed a historic Iowa tax reform bill. One of the biggest changes from the bill is that starting in 2023, Iowans aged 55 or older are exempt from paying state taxes on retirement income...

[+] Full Article

April marks the start of Financial Literacy Month, a nationally recognized movement to promote and support financial understanding in children and teens. For many, it's a fantastic opportunity to teach and connect with their children or grandchildren...

[+] Full Article 2023 Changes to Iowa's Retirement Taxes - 03/01/23

In March of 2022 Iowa Governor Kim Reynolds signed a historic Iowa tax reform bill. One of the biggest changes from the bill is that starting in 2023, Iowans aged 55 or older are exempt from paying state taxes on retirement income...

[+] Full Article

|

|

May 7, 2018 How much attention do you pay to this factor?

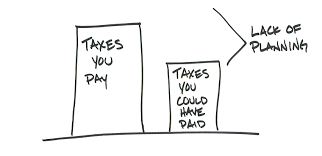

Will you pay higher taxes in retirement? Do you have a lot of money in a 401(k) or a traditional IRA? If so, you may receive significant retirement income. Those income distributions, however, will be taxed at the usual rate. If you have saved and invested well, you may end up retiring at your current marginal tax rate or even a higher one. Read more » |

|

|

April 20, 2018 Classroom educators are coping with hybrid plans and pension fund shortfalls.

Arizona. Kentucky. Massachusetts. Michigan. Pennsylvania. Rhode Island. Tennessee. In these states and others, teachers are concerned about their financial futures. The retirement programs they were counting on have either restructured or face critical questions. Read more » |

|

|

November 27, 2017 Here are some things you might want to do before saying goodbye to 2017.

What has changed for you in 2017? Did you start a new job or leave a job behind? Did you retire? Did you start a family? If notable changes occurred in your personal or professional life, then you will want to review your finances before this year ends and 2018 begins. Read more » |

|

|

September 12, 2017 If you’re going to say “I do,” here are some things you might want to do.

Are you marrying soon? Have you recently married? As you begin your life together, it is important for you to start planning your financial future together and putting your finances on the same page. Here are some priorities you might want to write down on your financial to-do list. Read more »

|